“Lazy hands make for poverty, but diligent hands bring wealth.” – Proverbs 10:4

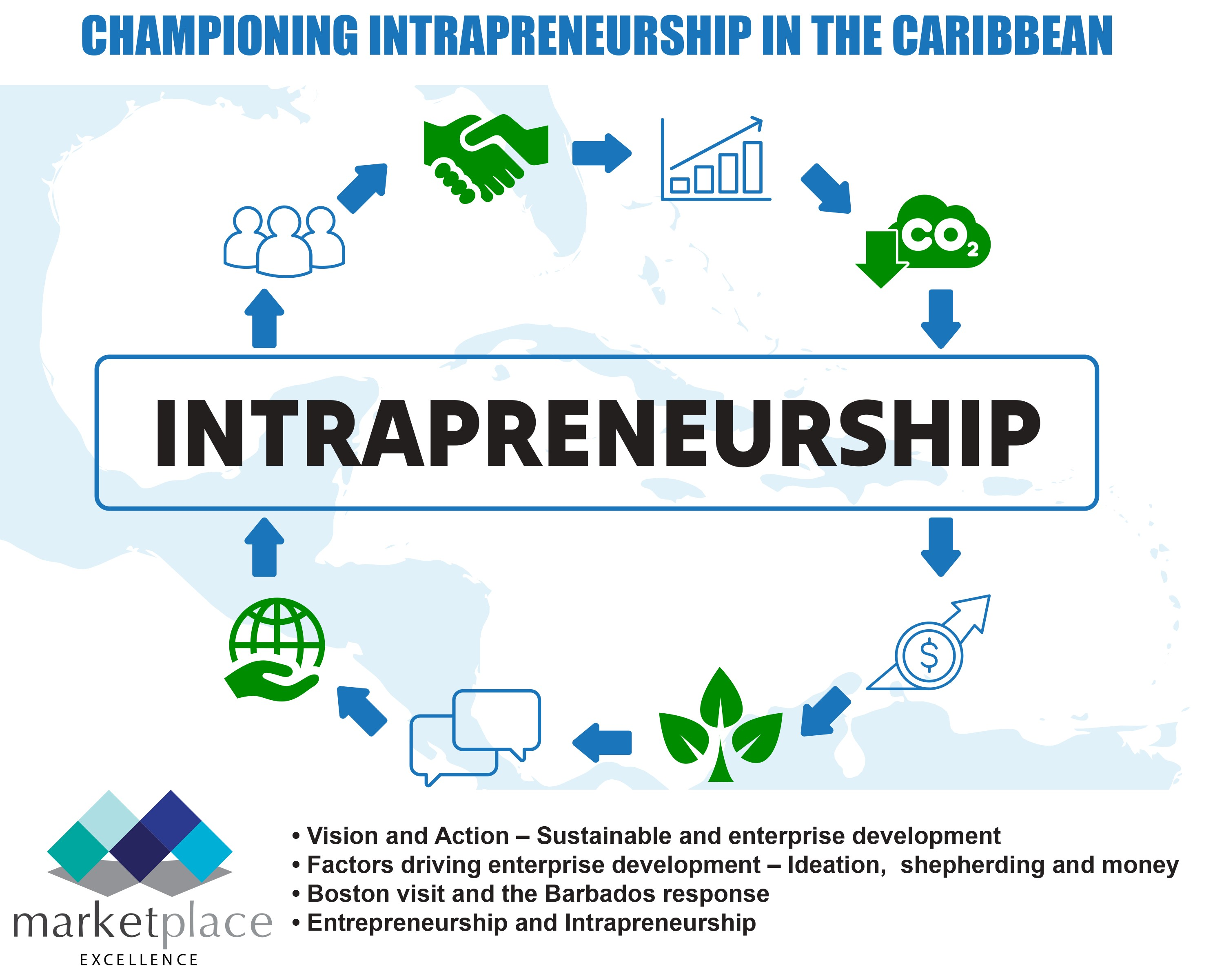

In our last column, we envisioned that sustainable development, ensuring that we meet the needs of today without jeopardizing the prospects of future generations, is the beacon which leads the way and that enterprise development is the path we must tread towards the vision. The legacy we leave for future generations depends on our commitment to this noble cause.

In recent years, the Caribbean region has experienced an upsurge in entrepreneurial endeavors, with startups championing innovation and diversifying the economic landscape.

Amid this trend, there’s an undercurrent driving success in established organizations that’s equally potent – intrapreneurship. Intrapreneurship, defined as the practice of entrepreneurial activities within an existing organization, has emerged as an indispensable force for businesses in the Caribbean.

The major factors driving enterprise development are ideation, life skills and business mentoring and finding timely access to appropriate capital.

In my experience, there is a plethora of “DNA of an Elephant” ideas in a wide range of economic sectors. However, the skills of a shepherding squad (life skills and business mentoring) have not been effectively utilized to guide entrepreneurs and intrapreneurs on a path to success.

Many sources of capital have been tried, namely grants, venture capital, micro finance, loans, equity and private finance, but the startup failure rate has been unacceptably high.

In 1986, it was apparent that entrepreneurial activity had been enhanced, both in Silicon Valley and in Boston, by the growth of the venture capital market.

I visited Boston and returned to Barbados “bright-eyed and bushy-tailed” all ready to make something happen. I mounted a workshop to present my findings of the tour and even though many people attended there was little private sector interest in establishing a local venture capital fund.

There were two interesting responses to my presentation. One from the late Sir Courtney Blackman, the governor of the Central Bank of Barbados at the time, and the other from the late Sir Douglas Lynch, who was then chairman of Barbados Shipping and Trading Co. Ltd. (BS&T), now part of Massy Group.

The governor proposed that the reserve requirement of commercial banks, lodged at the Central Bank, could be reduced and the difference used to capitalize a venture capital fund to stimulate entrepreneurship. Indeed, the concept of shepherding (value chain coordination, mindset change, business skill set change and cross cultural communication change) as a risk mitigation measure, which is gaining traction today, had not yet been formally introduced. The governor’s concept never saw the light of day.

The other interesting response from BS&T actually resulted in the introduction of intrapreneurship, i.e. an employee who promotes innovation within the limits of his or her organization. The BS&T directors provided a sum of money to encourage internal entrepreneurs to come up with new ideas for the benefit of their company.

As the Caribbean continues to navigate the waves of the global economy, championing intrapreneurship becomes crucial, serving not just as an organizational strategy but a regional imperative for sustainable growth.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com).