“Trust in the Lord with all thine heart; and lean not unto thine own understanding. In all thy ways acknowledge him, and he shall direct thy paths.” – Proverbs 3:5,6

Well the intelligence last week, just prior to the Barbados general election, that there was a mood in the air for political change, was bang on. What a change it was – an unprecedented clean sweep! Congratulations to Prime Minister Mia Mottley and her team!

I recall Ms Mottley’s address about the need for corporate governance reform for small states at an annual gathering of the Barbados Entrepreneurship Foundation, about eight to 10 years ago. In particular, she articulated her commitment to implement such change should she find herself in a position to do so. Now is the time.

In a media interview after the PM’s swearing-in ceremony, it has been reported that she would want to (1) meet with the leadership of the Social Partnership to achieve consensus on the way forward with mission-critical issues, (2) understand the Government’s exposure to contingent financial liabilities on a number of contracts, (3) get a clear picture as to the true state of the Government’s finances so that decisions can be made and (4) make public the report from the latest International Monetary Fund (IMF) on the review of the economy.

PM Mottley has subsequently released the IMF report and announced 21 Ministries, 30 members of Cabinet and 12 Government Senators. The appointment of the seven independent senators appointed by the Governor General and the two “opposition” senators will complete the governance structure.

Back to this series of articles.

We have so far suggested smart solutions for (1) constitutional reform, (2) public-private partnerships, (3) the political process, (4) decentralized government and (5) innovative taxation. Today, we look at a sensible smart solution to address (6) debt restructuring in partnership with local and global partners.

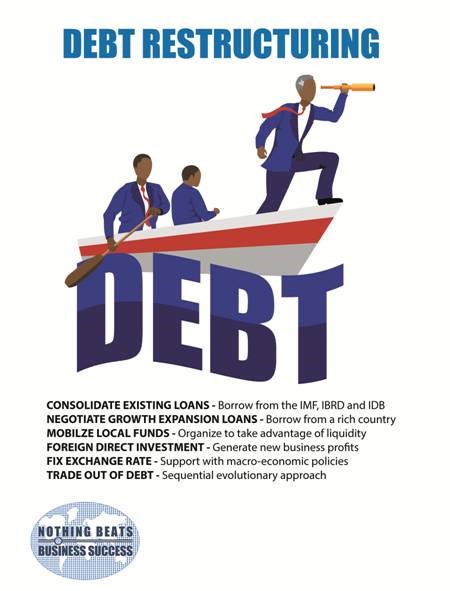

The graphic below conveys that national debt is like a ship on an ocean. It starts on the shore with shallow waters but with the moving tide the waters increase in depth. The deeper the waters the harder it is for the sailors of the ships of state to manage the debt. However, as shown in the graphic, if they work together – led by an experienced and determined shepherd – they can be successful in reaching the shores again. The shepherd should pursue the following four-pronged strategy.

Component 1 – leverage our memberships in the IMF, World Bank and Inter-American Development Bank to obtain resources (global experience and loans). It is incumbent on the shepherd to regard an approach to these institutions as an entitlement not a weakness and negotiate the best loans on acceptable terms.

Component 2 – give incentives to the local private sector to gain access to their resources (expertise and liquidity). The financial health of a country should not only be measured by the state of government’s finance but also by the wealth of its private sector. Models must be pursued by the shepherd for the public and private sectors to work in harmony for the mutual benefit of the private sector and the people. An opportunity waiting to happen is for government to incentivize the private sector to provide funds through the Shepherding model to entrepreneurs in the interest of enterprise development.

Component (3) – negotiate relationships with rich countries (mutually beneficial creative investment finance). An example of this to approach countries such as the oil-rich Arabs about loans to aid the small state national economy. The shepherd must negotiate the loan to the mutual benefit of the donor and the small state.

Component (4) – invite foreign direct investors (global business innovation ideas and investment funds). Investors abound globally but they will only invest when there is a favourable investment climate. Order of business #1 is therefore for the shepherd to enhance the brand image of the small state so that this state image gives rise to a bright blip on the investor’s radar.

These resources will be combined to (A) restructure debt in small states and (B) invest in innovative growth strategies in the hi-tech manufacturing, innovative agriculture, tourism diversification, enterprise development, financial services, renewable energy, information and communication technology, creative consulting and cultural (fine and culinary arts, music, graphic design, film, drama, media, technology and the fashion) industries.

Dynamic involvement in these industries will facilitate trading out of debt using a systematic evolutionary approach and collectively securing financial stability, establishing and maintaining a fixed exchange rate (supported by appropriately fluctuating macroeconomic policies), reducing poverty, increasing international trade and reducing high employment as we sustain sustainable economic growth.

This smart solution is conceptually simple as a vision, but the challenge comes in the management of the implementation process.

Let us recognize that the smart solution to get out of national debt is to partner with others to restructure that debt and then to focus on growing the economy.