“The law of the Lord is perfect, reviving the soul; the testimony of the Lord is sure, making wise the simple.” – Psalm 19:7

In our businesses, we routinely engage accountants to compile financial statements, including balance sheets, income, and cash flow statements, for management accounting and revenue authority filing purposes.

Now, let’s shift our focus to personal finance. Managing a family’s finances often entails navigating a complexity similar to running a small business. Families typically juggle multiple income sources and a pool of essential expenses.

In this context, the suite of financial tools used in business remains relevant and highly effective.

Yet, many overlook their relevance in personal finance. Today, I want to emphasize why the balance sheet, a cornerstone of business financial management, is equally important in managing personal finances.

Earning money enables us to cover weekly direct and indirect expenses, pay taxes for public services, build a pension for retirement, provide for our children’s education, and secure a dream home for the family.

If you want to obtain a snapshot of your personal or family finances at any given time or wish to forecast their future state, the balance sheet dashboard is the answer. It serves as a visual tool providing timely information on specific financial questions.

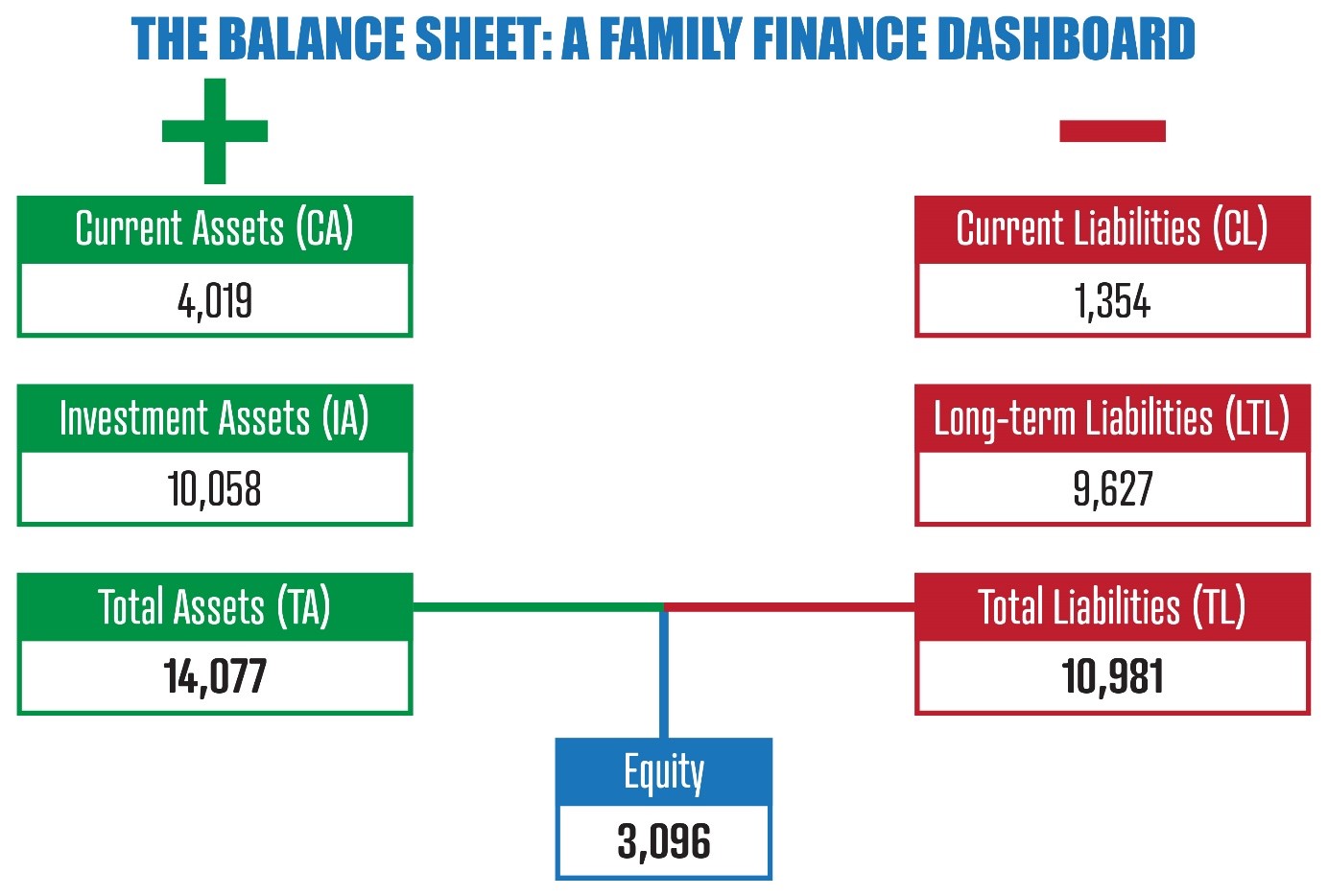

The graphic herein hypothetically depicts a simple balance sheet structure. It comprises seven primary elements: current assets, current liabilities, fixed or investment assets, long-term liabilities, total assets, total liabilities, and equity or net worth.

Total assets equal total liabilities plus equity, forming the basic accounting equation that ‘balances’ the balance sheet.

Total Assets = Total Liabilities + Personal Equity

Current Assets (CA) represent a family’s resources, such as cash in the bank or funds due in the short term. These assets are crucial, as their conversion facilitates the payment of Current Liabilities (CL), like day-to-day operating expenses, bills, and loan payments.

Fixed or Investment assets (FA) encompass tangible or intangible items acquired for generating additional income or held for speculation in anticipation of a capital gain. Examples include mutual funds, stocks, bonds, real estate, and retirement savings accounts.

Long-term Liabilities (LTL) denote debts owed to third-party creditors, payable over years, distinguishing them from current liabilities.

Total Assets (TA) equal CA + IA; Total Liabilities (TL) equal CL + LTL; and Total Assets minus Total Liabilities equal Net Worth (NW).

When reviewing your dashboard from month to month, it’s essential to ensure that your current assets healthily exceed your current liabilities. Otherwise, you may experience an undesirable and embarrassing situation where you cannot pay your monthly bills. Failing to pay these bills will necessitate immediate corrective action.

Similarly, monitoring the growth of your investment assets and the decline of your long-term liabilities is crucial since it confirms that your investments are working while you sleep.

Sustaining a positive balance when subtracting your current liabilities from your current assets and experiencing a growing gap between your investment assets and your long term liabilities confirms the growth in your net worth, reflecting your overall financial objective.

Net worth signifies the value of all assets less the total liabilities. Simply put, it represents the difference between what is owned and what is owed.

You may seek assistance from an accountant to calculate the growth of your net worth with time.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at https://www.nothingbeatsbusiness.com).