“The plans of the diligent lead to profit as surely as haste leads to poverty.” – Proverbs 21:5

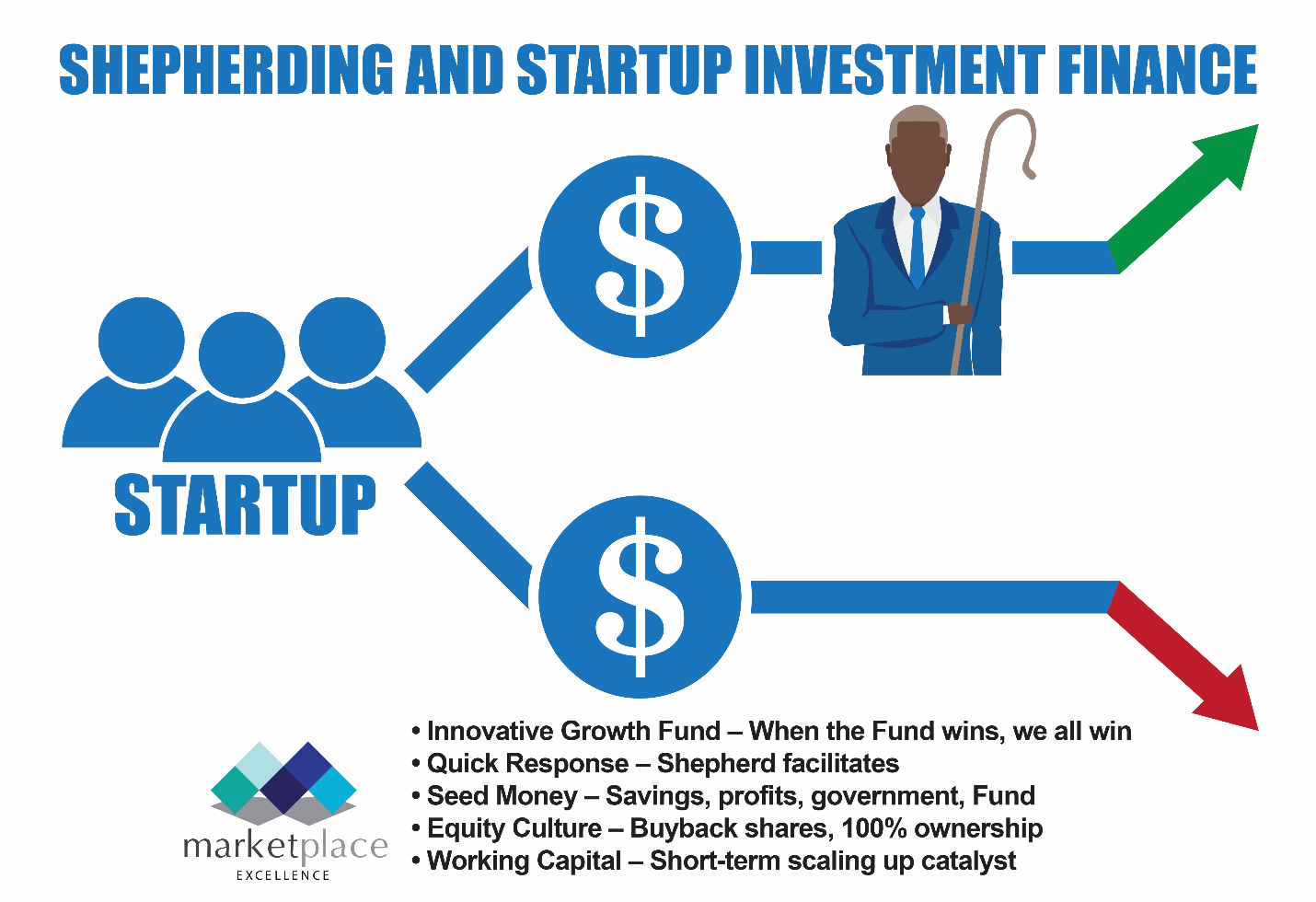

Today’s topic will address (1) establishing a quick response seed/equity/working capital growth Fund; (2) seeking the shepherd’s quick response investment guidance; (3) sourcing seed money to launch the business; (4) introducing an equity rather than a loan culture; and (5) accessing working capital.

When the Fund wins, we all win. Global investors, including the local private sector with government incentives, the Diaspora and governments will be invited to capitalize an innovative quick response diverse growth Fund, which will offer seed, equity and working capital services to startups.

This innovative Fund will be established as a Trust and will be managed by a fund manager.

Startups will be assigned shepherds who will guide the entrepreneur. As startups succeed and pay back the Fund, the Fund expands. Shepherds and fund managers are employed, jobs are created, and economies grow. Public and private investors get an economic and financial return on investment, respectively.

Shepherd facilitates quick response. The shepherd will, in a timely manner, recommend to the Fund a blend of seed/equity/working capital financial services to meet the needs of the entrepreneur. This reduces business risk and hence is a form of “collateral” to protect the financial investment.

Sources of seed money. A scalable startup will need seed money to cover costs, including shepherding, marketing, raw materials and labour before it lifts off and sets about the task of making profits.

If the entrepreneur has been careful, he or she will have savings which have been accumulated for the purpose of capitalizing the startup.

If the startup business can generate profits quickly, then these profits can be ploughed back into the company to initially retard the depletion of savings and ultimately contribute to the entrepreneur’s net worth.

If neither of the above is the case, the startup will have to rely on the benevolence of others or the seed capital component of the growth Fund. On the advice of the shepherd, seed capital is immediately advanced on a short-term basis by the Fund to the startup.

Equity not loan culture. A startup business does not normally qualify for a traditional bank loan because of the lack of hard collateral as security and the inability to immediately service blended monthly principal and interest payments because of weak initial cash flow. An equity culture fills this gap.

The shepherd prepares a business case to the Fund to invest in the startup through an equity instrument. The seed capital advance is rolled into this equity request and the startup issues shares to the Fund in return for the Fund’s investment in the startup. The fund manager prepares an equity agreement between the startup and the Fund to seal the deal.

When the startup’s cash flow is strong enough then the startup buys back its shares from the Fund at the market price on the day. The startup regains its 100% ownership, and the Fund grows.

Working capital as a short-term scaling up catalyst. At the appropriate time a startup may want to take a quantum leap into the export market. The shepherd prepares the business case and obtains a short-term working capital advance from the Fund secured by an export market contract.

We have diligently and patiently pursued a sustainable solution to the problem of a high failure rate for startups. We are now closer to the implementation of an innovative growth Fund. Please watch this space.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com.