“If you lend money to my people, to the poor among you, you are not to act as a creditor to him; you shall not charge him interest.” – Deuteronomy 23:19.

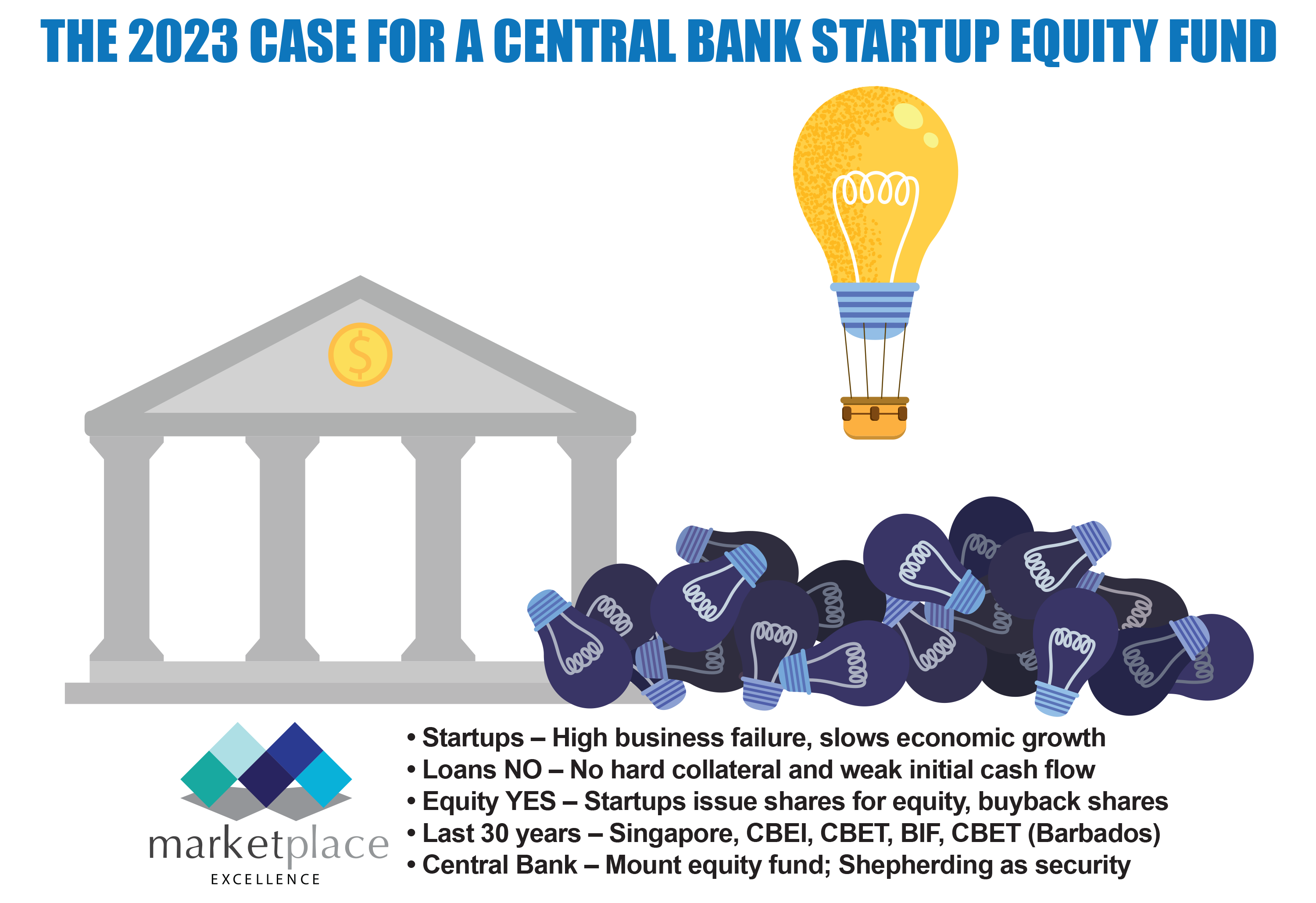

The appalling global startup failure rate of 90 percent in the first five years of operation would suggest that they are weaknesses in the strategic approaches to invigorate and sustain the performance of these startups.

My Caribbean experience over the past 30 years has led me to the conclusion that startups require guidance and innovative financial investment to emerge and thrive.

The guidance is in the form of a combination of life coaching, which counsels and encourages entrepreneurs through personal or career challenges; and business mentoring, which introduces entrepreneurs to the systematic management of business systems on the journey to business success. This combination has been termed “shepherding”.

Startups are unlikely to have hard collateral as security for a loan. Their cash flow is weak initially and they often cannot commit to a fixed monthly loan repayment for a predetermined term. Therefore, they do not qualify for commercial bank loans, the most readily promoted instrument in the financial marketplace.

Also, when money is thrown at startups in the form of grants, very often, after six months say, neither the grant, the entrepreneur nor the business can be found.

Startups need a responsive, innovative, self-sustaining, equity capital investment fund to capitalize their business. In this context, the startup will issue shares to the fund in return for equity finance from the fund. Later on, when the startup’s cash flow permits, the startup will buy back its shares from the fund and reestablish 100 percent ownership of the business.

The rationale in support of this arrangement is that shepherding mitigates the risk of business failure and, hence, secures the fund’s equity capital investment.

My experience began with a memorable visit to Singapore in 1993, which signaled the beginning of my uninterrupted series of weekly newspaper columns.

The Caribbean Development Bank (CDB) engaged me as consultant (services exports) from 1998 to 2001. This resulted in a report entitled Caribbean Business Enterprise Initiative (CBEI), the statement of purpose of which was “to be a Caribbean catalyst turning concepts into commercial realities.”

The implementation of CBEI was funded by private and public sector entities in the Caribbean, including the central banks of Barbados and Belize along with the Eastern Caribbean Central Bank.

This allowed me and my team to share the CBEI concept throughout the Caribbean (2001-2008) under the aegis of the Caribbean Business Enterprise Trust, registered in St. Lucia. The Trust was chaired by Sir Neville Nicholls.

The Government of Barbados funded CBET (Barbados) to test the efficacy of the CBEI concept in Barbados (2008-2012) with pleasing results before it was prematurely terminated after the untimely passing of Prime Minister David Thompson.

Since then, I have been applying the concept virtually when requested, but an innovative equity fund is still a missing link in the armory of the startup investment landscape.

May I take this opportunity to congratulate Dr. Kevin Greenidge who has recently been appointed the eighth Governor of the Central Bank of Barbados. I have engaged with all the governors since the bank’s inception in 1972, some more than others.

Incidentally, the Central Bank of Barbados established the Barbados Investment Fund (BIF) in 1992 to address the needs of startups, but the fund is no longer operational.

Hopefully Dr. Greenidge, who is an architect of the effective Barbados BERT and BOSS+ economic programs, will buy into this vision and will work towards establishing an innovative startup equity fund which will be a Caribbean catalyst, turning concepts into commercial realities.

Next week we shall share a proposed structure and the varied benefits of such a fund.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com).