“Watch yourselves, so that you may not lose what we have worked for, but may win a full reward.” – 2 John 1:8

My maternal grandfather, circa 1900, entered the job market as a teenager. He got married and started a family in his late 20s and soon after fulfilled his passion and became the owner of a hardware store and the builder of bungalows to generate revenue, make a profit, build projected cash flow, and net worth (represented by a projected balance sheet) which defined his pension plan.

My father did not know his father, who passed away at age 27 when my father was in his mother’s womb. She migrated to the United States as a homecare entrepreneur (her passion) and sent money back to educate her three sons, whom she left in Barbados under the care of her sister-in-law, my father’s aunt, a schoolteacher without any children of her own. She returned to Barbados eventually and lived rather modestly, but independently, secured by a private savings pension plan.

Whereas my two uncles won Barbados scholarships which allowed them to pursue their education abroad, my father was proxime accessit in his year (only one such scholarship per year in the 1930s). He was forced to join the civil service on leaving school and worked his way to the top. All three brothers found their passion in working for the local, regional or international public sector and they all benefited from employee pension plans.

My own story speaks of Montessori school, primary and secondary education with the support of my parents, and then onto undergraduate and postgraduate education with the support of scholarships, an insurance policy, and graduate assistantships.

I started my first full-time job as an employee in 1968 at the age of 27 years as a married man with a family. I experimented with exporting oranges and later dried sorrel as a hobby from Trinidad to Barbados in 1970 and became a full-time entrepreneur as a Barbados-based Caribbean business consultant (my passion) in 1977. Real estate investment was my pension plan.

My three children and their late mother, even though in diverse disciplines, each found their passion and worked hard to convert them to success.

As an employee or entrepreneur, the focus ought to be on following your passion and earning a living.

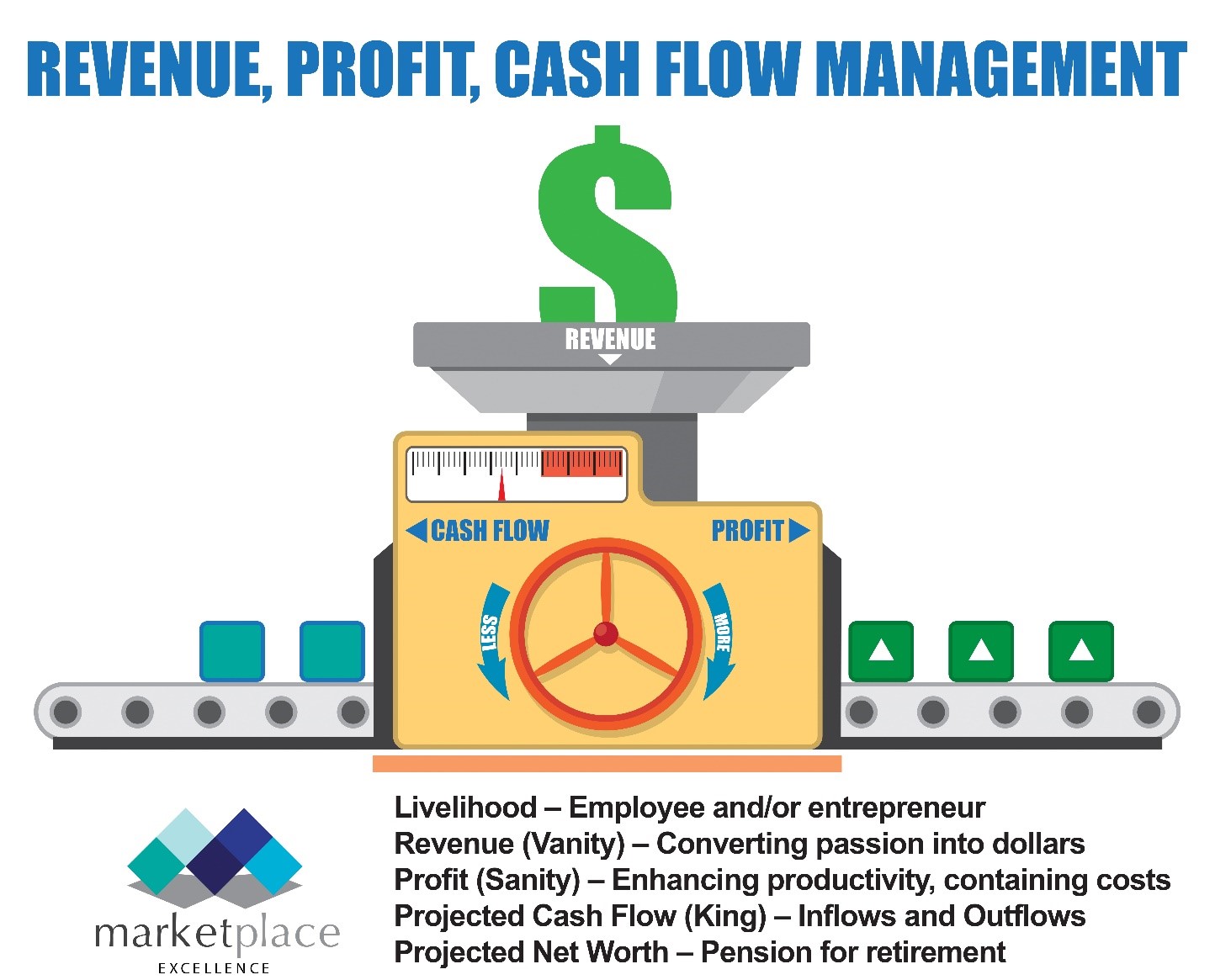

We generate profits by enhancing productivity and containing costs. A positive projected bank balance (cash flow) pays for basic needs (food, shelter, clothing) and investments towards financial security (net worth) obviate the dependence on others when we have retired from the workforce.

As has been said: “Revenue is vanity, Profit is Sanity, but Cash Flow is King”. These three are necessary for the achievement of a family’s well-being and happiness in life but the greatest of these is cash flow.

In summary, to manage your projected cash flow, you should (1) increase your sources of revenue; (2) enhance productivity and contain costs; (3) motivate your product or service delivery team; (4) deliver excellent products and services; and (5) diligently collect your receivables in a timely manner so that you do not lose what you have worked for but receive the full rewards for your labour.

Many families have adopted these principles and economies have grown from strength to strength.

Then COVID-19 hits, conspiracy theories run rampant, anti-vaccination proponents emerge, the pandemic gets out of control, businesses collapse, jobs are lost, earnings decline and so too the circular flow of money. Families become dependent on others and governments are challenged to find solutions.

Whatever the ultimate solution the above principles still obtain.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com)