“Feed me with the food that is needful for me.” – Proverbs 30:8.

If we define economic development as an overall improvement in the quality of life and living standards, including measures of literacy, life-expectancy and healthcare, then surely this should be the primary goal of each country in the world.

Economic growth, on the other hand, is measured as an increase in the amount of goods and services produced per head of the population over a period of time. Economic growth comes from the productive sectors, the mix of which (agriculture, marine, enterprise development, tourism, manufacturing, financial services, ICT, mining, renewable energy and the creative industries) varies from country to country.

There is, however, a sub group (low hanging fruit) of these sectors which are available in varying quantities in each country e.g. agriculture and/or marine, enterprise development, renewable energy and the creative industries. These come from our basic resources – physical, environment and people.

We would expect economic growth to enable more economic development, however, the link is not guaranteed and in many cases the proceeds of economic growth could be wasted or retained by a small wealthy elite. We need to empower each individual with visions of abundance and grandeur which could ultimately lead to a reduction of the wealth divide.

We need to promote enterprise development. Economic growth can only happen one successful enterprise after another and hence the focus has to be on enterprise development.

The “3M” construct of an enterprise should not be ignored – Idea Model (Innovative Entrepreneur), Management Model (Shepherding), and Money Model (Investment options).

We usually think of investment in terms of money only. In the “3M” construct of an enterprise, what if we regard the Entrepreneur as investing his idea, the Shepherd as investing some time (there are 24 hours a day at his or her disposal some of which can be set aside for investment, the rest is needed for sleep, earning, personal and social activities), and the Investor as investing his/her money. They are each entitled to a return on their investment. This return is going to come from the profits of the enterprise, so we better make it work.

My observation is that there is no shortage of ideas mainly from the youth but not excluding the more experienced in our communities. The Shepherding concept has been promoted and tested as a means of mitigating business risk and increasing the chances of business success. It is gradually gaining traction in the Caribbean. The outstanding problem to be solved in the “3M” construct is the money. What we do know is that there is no shortage of money for enterprise development – the problem is accessing it! The barrier is perceived risk by the prospective investor. Shepherding mitigates this risk.

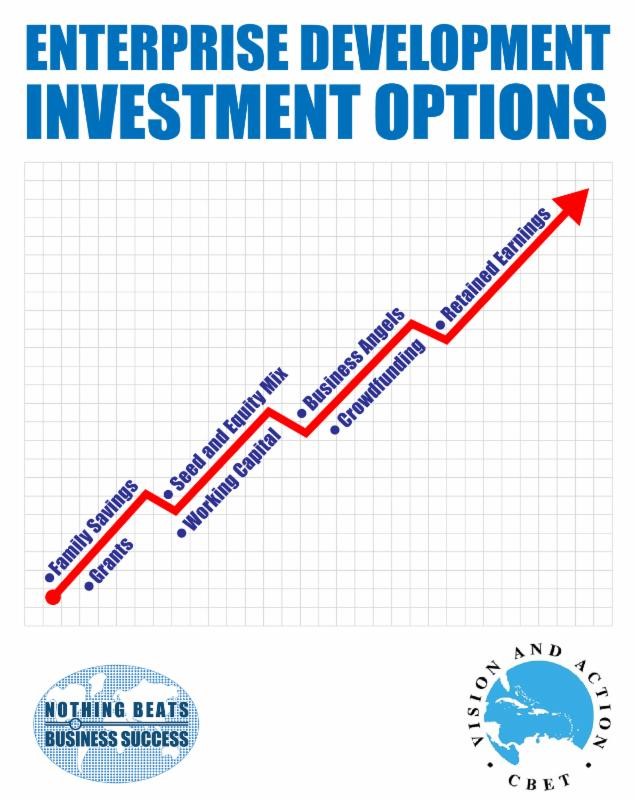

If we insist on coupling Shepherding with the protection of Family Savings, Grants, Seed and Equity, Working Capital, Business Angels, and Crowdfunding, then business profits (retained earnings) will be secured and we have prospects for a sustainable economic development system.

God has given us ideas, he has blessed us with management expertise and some of us with money. Let us use our good judgment and handle these resources wisely – we have plenty to give and to share as we lessen the wealth divide.

(Dr. Basil Springer GCM is Change-Engine Consultant, Caribbean Business Enterprise Trust Inc. – CBET. His email address is basilgf57@gmail.com and his columns may be found at www.cbetmodel.org and www.nothingbeatsbusiness.com.)