“The LORD is my shepherd; I shall not want.” – Psalm 23:1

One role of a central bank is to be innovative in stimulating the growth of the economy.

What if a central bank can initiate and nurture a project which can significantly reduce a high five-year startup business failure rate and grow the economy? Wouldn’t that be an incredible value proposition?

The Food and Agriculture Organization (FAO) has stated that almost everywhere in the world, a child born in 2021 had a better chance (95 percent on average) of surviving to age five than in 1990, when the probability was 25 percent.

Programmes to improve the dissemination of household food security and nutrition information were primarily responsible for the increase in a child’s chances of growing to adulthood.

My hypothesis, therefore, is that if we pay attention to the process of providing the information necessary for business health and growth we will have a much greater chance than 10 percent (2023) of a startup business growing to maturity, thus boosting the economy commensurately.

It is proposed that the shepherding system disseminate life coaching and business mentoring information to the startup and protect against the risk of startup business failure.

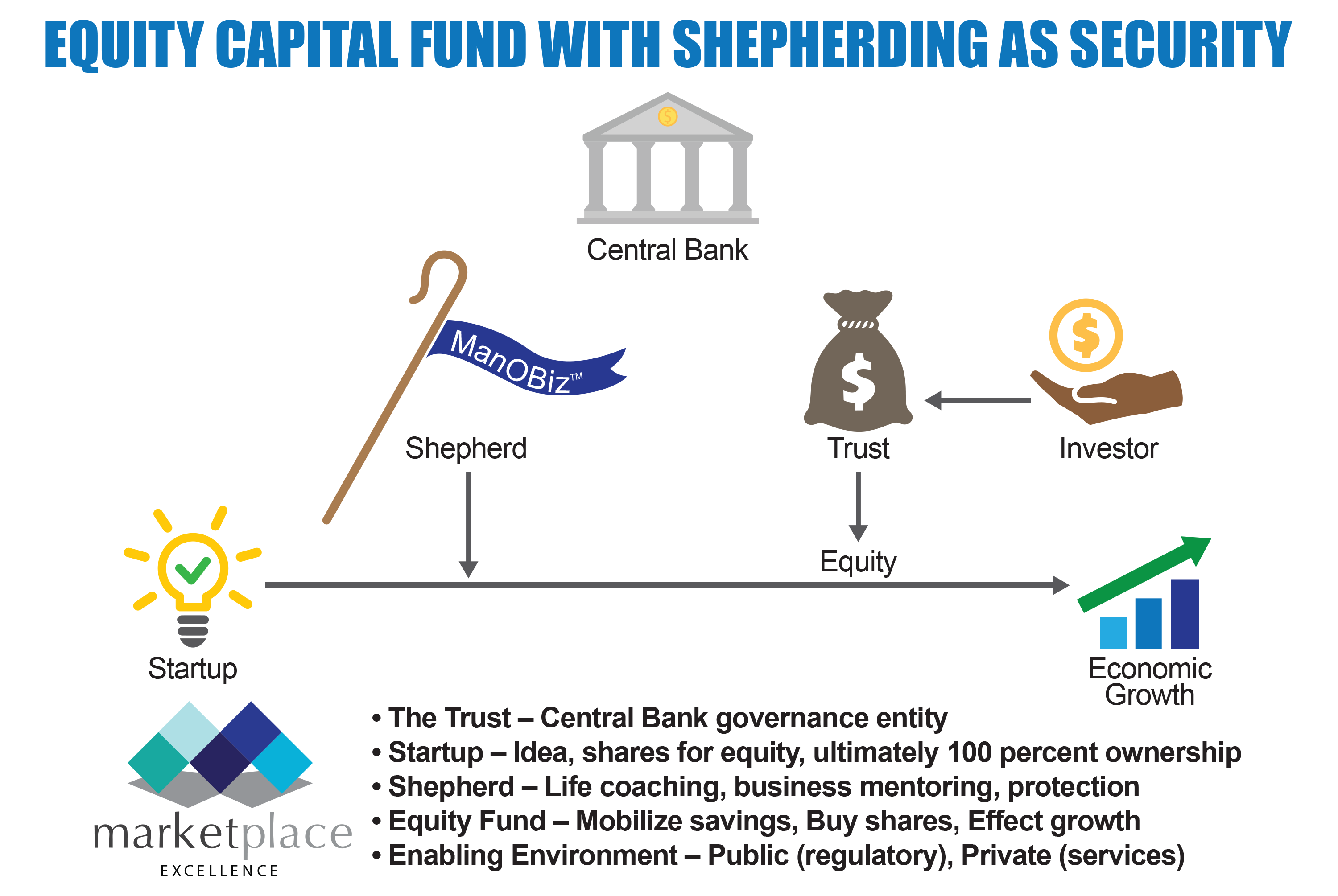

The five primary stakeholders of such a project are (1) Trust (the legal entity which governs the Shepherding System and the Equity Fund); (2) Startup (an entrepreneur with an idea who starts a business, taking on financial risks in the hope of making a profit); (3) Shepherd (an experienced businessperson(s) or consultant(s) who is willing to share his/her life coaching and business mentoring expertise, individually or collectively, as an act of corporate social responsibility or for a modest fee); (4) Investor (mobilizes private sector savings by accepting government incentives); and (5) Enabling environment (public regulatory and private services inputs).

The proposed challenge to central banks is to establish a trust, the purpose of which is to govern the Shepherding System and a quick-response, revolving, self-sustaining and profitable Startup Seed/Equity Fund.

The trust will appoint a chairman, private sector trustees and a project manager and will meet monthly to set targets, review management performance and take corrective action where necessary.

The trust will report to the central bank on a quarterly basis.

The startup entrepreneur will supply “DNA of an Elephant” ideas (i.e., ideas with potential for export), offer company shares to the fund in exchange for equity to capitalize the company and, when cash flows are strong enough, buy back those shares from the fund at market price. The startup will ultimately regain 100 percent ownership of its company’s shares.

I recall an entrepreneur attending a workshop designed to pitch to funders to get his startup business off the ground. He eloquently began his presentation with an appeal: “Panel, you may be surprised by my remarks but I do not think I can make a successful case for funding, without guidance.” This reinforced the need for shepherding.

A shepherd, selected and trained by the project manager in the management of business systems matrix (ManOBizTM), is assigned to an entrepreneur.

The shepherd and startup determine the business model for the idea, estimate the investment cost of the startup, and offer shares to the fund in return for commensurate equity.

Entrepreneurs and shepherds then execute the plans, and the business is on its way.

The central bank will liaise with the ministry of finance on the process of mobilizing private savings, with government incentives, in order to capitalize the fund.

Investors invest in the equity fund, the fund invests in the startups, the startups grow and when the startups buy back their shares, the fund grows and the ultimate beneficiaries of the fund are the people of the country.

The startups will thrive in an enabling environment where the regulatory environment is accommodating, including a corporate affairs office and securities exchange, where export-facilitating services and an entrepreneurs’ academy are in place, and where banking, legal, corporate secretarial, accounting and auditing services are readily available.

If the startups win, we all win.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com).