“Do not be conformed to this world, but be transformed by the renewal of your mind, that by testing you may discern what is the will of God, what is good and acceptable and perfect.” – Romans 12:2

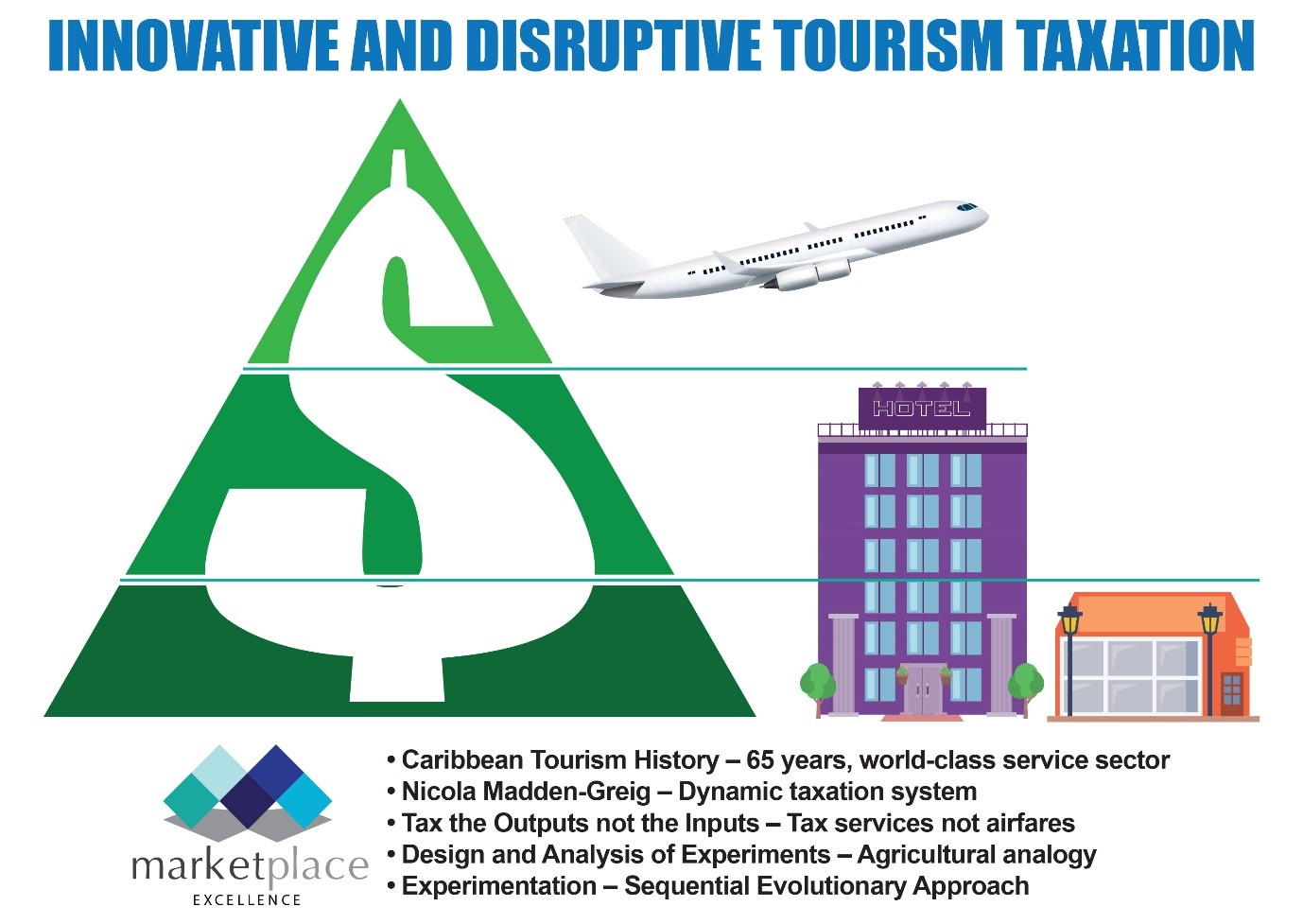

Over the past 65 years, more than 30 warm-weather tourism destinations in the Caribbean archipelago of islands and coastal communities have attracted leisure and business visitors alike.

Tourism has matured into a world-class service sector and the taxation derived from this has been a major boost to the economies of the region. The vision of Caribbean destinations is to penetrate the global market efficiently and successfully.

The MPE Caribbean Report of Monday. September 26 conveyed the highlights of a “dynamic taxation system” proposal by Nicola Madden-Greig, president of the Caribbean Hotel and Tourism Association (CHTA), to address the vexing airline ticket tax issue, which was debated during IATA Caribbean Aviation Day in the Cayman Islands last month.

The issue is that the cost of an airline ticket is too high and is a disincentive to travel. The government tax can be a significant component of the cost of the ticket.

Madden-Greig is proposing a seasonal reduction in the government tax component of the airfare to increase the number of persons traveling, say in the low season, and recovering some of that lost ticket tax revenue on the tourist spend at the destination e.g. accommodations, food & beverage, recreation, entertainment, transportation etc.

If the ticket sale is lost because the cost is too high for the traveler, then the potential traveler’s spending money never reaches the destination, which impacts negatively on the economic return to the destination. The challenge is to get more people to the destination and maximize the total tax collected.

The implication here is to reduce the taxes on the air fares (inputs) and tax the destination services (outputs) or, put more colloquially, “tax the outputs not the inputs”.

I have continually referred to this concept in my weekly columns. I recall first hearing the phrase used many years ago by experienced Barbadian economist Dr. Frank Alleyne (now Sir Frank) but not necessarily in the context of the tourism industry.

In the case of President Madden-Greig’s proposal of a “dynamic taxation system”, we need to determine what is the distribution of tax, between inputs and outputs, governments need to levy on the industry to optimize the economic return from visitors to the Caribbean.

Let us learn from a simple agricultural experimentation analogy with which I am very familiar. The objective is to determine the optimal level of nitrogen/phosphorus/potassium fertilizer at a given price per kilogram that should be applied to a crop (pigeon peas, say) to maximize the profit per acre of the crop.

If we apply too little fertilizer, the profit per acre, at a given fertilizer cost, will be low. If we use too much fertilizer, this may damage or even kill the plant and the profit will also be low.

What is the optimum amount of fertilizer at that price to be applied to the plant to maximize the profit per acre? This is a decision problem, and the optimal amount of fertilizer to be applied is solved using classical experimental design and analysis methodology.

Tourism taxation will no doubt be the mainstay of the economies of the Caribbean in the future. Governments must experiment by innovating and disrupting its tourism taxation policies, using a “Sequential Evolutionary Approach”, to fuel the growth and sustainability of the industry.

Like in other decision-making problems, the Nicola Madden-Greig proposal to solve this optimization problem calls for an empirical solution. Let’s start fixing this now with passion, persistence and patience.

(Dr. Basil Springer GCM is a Change-Engine Consultant. His email address is basilgf@marketplaceexcellence.com. His columns may be found at www.nothingbeatsbusiness.com).