“Whoever is generous to the poor lends to the Lord, and he will repay him for his deed.” – Proverbs 19:17

In this series, we have so far suggested smart solutions for (1) constitutional reform, (2) public-private partnerships, (3) the political process and (4) decentralized government. Today we look at a sensible smart solution to address (5) an innovative taxation system which yields more and more taxes to pay for government services, facilitates tax collection and provides incentives for “the rich to get richer and the poor to get richer too”.

Before we get into the meat of this column, there is a Barbados general election on Thursday May 24, 2018. In a recent report, the Central Bank of Barbados does not paint a pretty picture of the performance of the economy nor of the prospects of recovery in the short- and medium-terms, given the existing policies.

Intelligence suggests that there is a mood for change. Independently, it may be argued that it is sheer madness to continue with the same policies of a political administration (in power for the last 10 years) and expect different results.

The primary responsibilities of a small island state government when elected are to (1) make laws (including rules and regulations), (2) restructure debt, (3) maintain the foreign reserves well above a safe minimum level of import cover, (4) control the money supply to protect against inflation, (5) offer incentives to the private sector to grow the economy, (6) reduce and contain government expenditure and (7) provide services.

Government revenue to provide day-to-day services is obtained from taxation. Capital works such as ports, roads and buildings require loan financing.

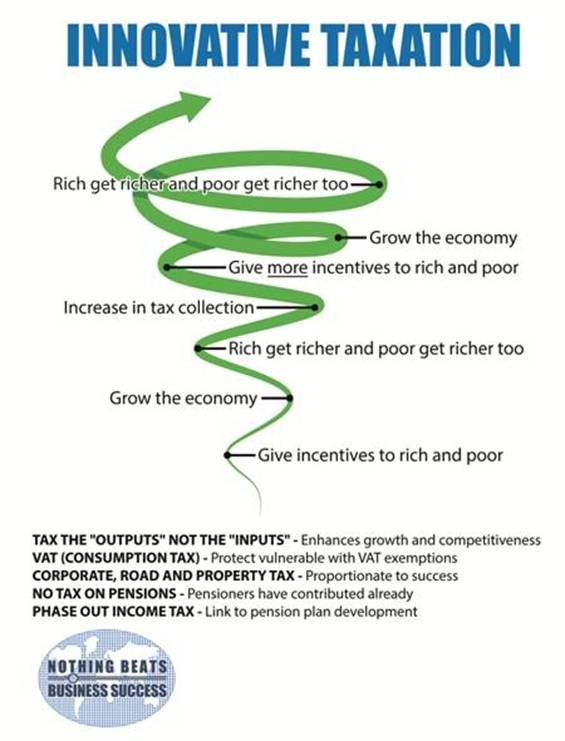

The spiraling effect in the graphic below embodies the effect of innovative taxation.

An innovative taxation environment involves “lateral thinking”. Here is a mix of taxation concepts which could be useful in developing a smart solution: (1) Tax outputs not inputs; (2) VAT; (3) Corporate, road and property tax; (4) No tax on pensions; and (5) Phase out income tax.

When inputs to any industry are taxed then competiveness is immediately negatively impacted which results in loss of output and economic growth. An alternative strategy is to forgo the input taxes, allow the economy to grow and then tax the outputs. A tax on outputs is more easily collected because of positive cash flow. Government may have to rely on loan financing to replace the revenue lost by not taxing inputs, but the net long term benefits could be significant.

VAT is a tax on consumption and hence to some extent the taxpayer can control his tax liability in this regard. As the economy grows and consumption is increased then VAT revenue is increased. In a well regulated VAT system, VAT is an end user tax and it is collect by wholesalers and retailers on behalf of government. VAT exemption on special items will protect the vulnerable.

All businesses, vehicles and properties should be digitally registered, which facilitates the systematic collection of these taxes. As the economy grows more people will fall into the tax net and tax revenue could grow exponentially. Again, there may be some anomalies and the vulnerable should be protected.

Not all persons prepare themselves financially for retirement. The sudden transition from receiving a monthly salary to, in most cases, a much reduced pension comes as a shock. Some consideration needs to be given to pensioners to protect them when they retire. One way of doing this is to recognize the contribution that they have made to society over their working life and make their pensions tax free irrespective of the size.

We have grown up in a culture of personal income tax which is easy to collect from government workers and employees in structured private sector businesses. However, it is not that easy to determine the tax liability of independent contractors. A fair system would be to phase out personal income tax as the economy grows. Some small states have no tax on personal incomes – it might be wise to study their system as we plan to change.

Let us focus on revamping the taxation system so that it may give exponential yields as the economy grows.