“Whoever is kind to the poor lends to the Lord, and he will reward them for what they have done.” – Proverbs 19:17

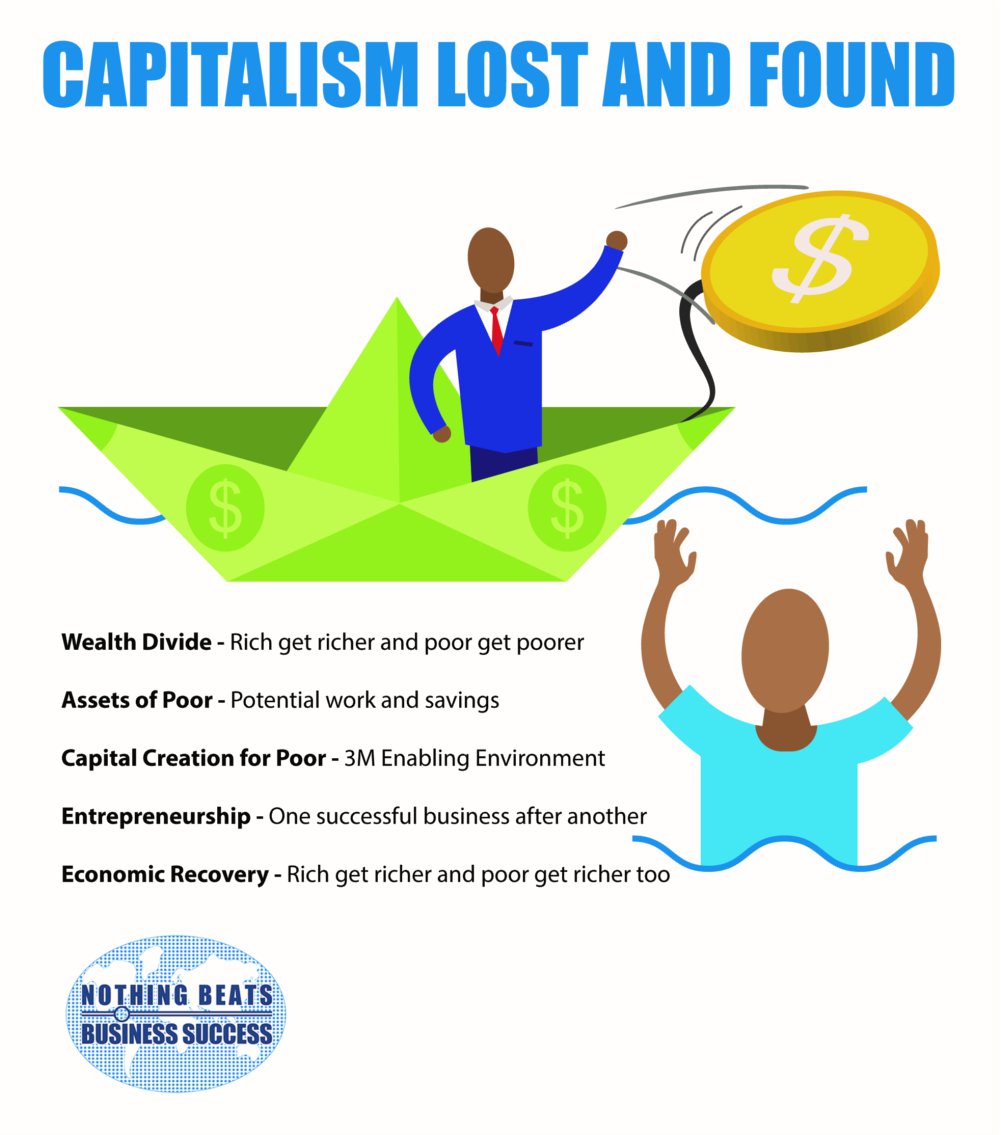

In many capitalist societies we observe that the rich get richer and the poor get poorer which defines the wealth divide. This ultimately results in unemployment, crime, economic decay and unhappiness.

As human beings, our assets are “ideas, work and savings”. However, especially in the case of the poor, we need a thriving business enabling environment to convert these assets into capital and growth in order to reduce the wealth divide.

In his book “The Mystery of Capital”, the world-famous Peruvian economist Hernando de Soto states that the central thesis is quite simple: you can’t solve the problem of stagnant, poverty-stricken economies unless you figure out how to make credit available so that people can start and operate businesses. This is a plug for enterprise development and even though the solution is conceptually simple it is not easy to implement.

A home grown attempt at a solution to this problem in the Caribbean has been presented as the 3M model of capital creation for the poor. It consists of the Metamorphosis, the Management and the Money, not just the credit.

The metamorphosis relates to the transformation of an idea, innovation or value proposition into a business concept with the “DNA of an elephant”. The management speaks to the concept of shepherding the entrepreneur so that obstacles are systematically cleared along the journey to business success. The money must be provided in a form which stimulates and supports the entrepreneur’s attempt to establish and grow the potential enterprise.

There is no shortage of business ideas with potential for growth. There is a plethora of management consultants who can mutate into shepherds with the appropriate training. However, the access to money has been traditionally through a “loan” financial instrument which frustrates the entrepreneur’s attempt to establish and grow the potential enterprise.

If the entrepreneur has a potentially viable business plan, the traditional conditionality for a loan includes (1) hard collateral, (2) immediate monthly repayment of principal and interest and (3) a fixed repayment period. The entrepreneur is often not in a position to provide hard collateral, the cash flow projections of the enterprise initially are usually not strong enough to support immediate monthly repayment of principal and interest and there are sometimes penalties if the enterprise does well enough to repay the principal balance well before the agreed upon repayment period.

A solution to the problem is an “innovative working capital financing” instrument where “management” replaces hard collateral, where “payment out of future profits” replaces monthly payments of principal and interest, and where “the exit clause” replaces the fixed repayment period.

This is where persons with excess disposable income can throw a life line, either individually or collectively, to the entrepreneur. Collective involvement is preferred because of the well established principle that “unity is strength” and the investment risk is spread over several entrepreneurs. Your excess disposable income may be getting little or no return in the current economic environment but financing the development of enterprises through an investment fund might be very attractive.

Such persons are encouraged to partner with enterprises and their shepherds towards a win-win outcome. The well researched, conceptualized and documented Barbados Entrepreneurs’ Venture Capital Fund which was launched in 2009 (currently lying dormant) is a useful creative business nucleus around which to build these concepts.

Let us all as leaders rescue the poor and empower them to convert their assets (ideas, work and savings) into capital so that they may one day become wealthy in their own right through the successful development of business enterprise. In this environment, the rich will get richer but the poor will get richer too. This will redound to the benefit of national economic recovery and sustainable economic growth.