“God is our refuge and strength, a very present help in trouble.” – Psalm 46:1

Three weeks ago we revisited five generic business systems and postulated that this perspective could be of great help in the management development process. The underlying pattern of these business systems is Structure → Security → Life → Growth → Sustainability which is the sequence that obtains in the evolution of the human species from which we can learn in the evolution of businesses.

Our only hope for sustaining national economic growth, a necessary condition for happiness in this world, is to allow the business development process to evolve from start-up, one successful business after another.

I promised to revisit these business systems in turn over the next several weeks. Two weeks ago, we began with the Corporate Governance business system, representing the structure, and concluded that “as a house is only as strong as its structure, so too a business is only as strong as the corporate governance system that underlies its operation. Please recognize that enterprise development is the sector on which our future economies will be built and start our businesses with a Shepherd and a board meeting”.

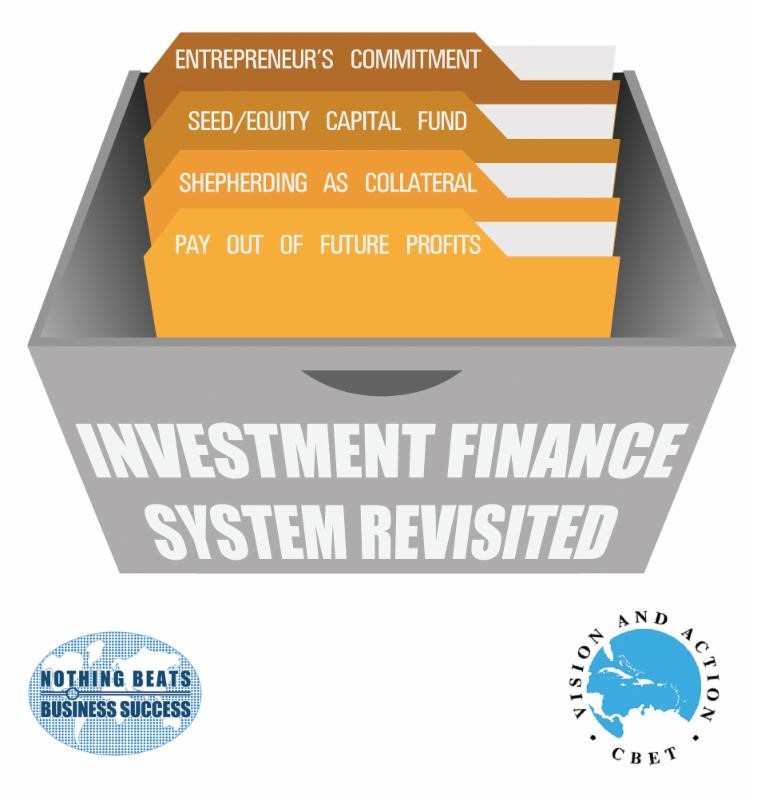

Today, we shall revisit the Investment Finance business system, representing the security which gives us confidence to proceed. The issues associated with investment finance are (1) the quality of the business and the entrepreneur’s commitment; (2) the type of funding that is most appropriate for start-up businesses; (3) the effective management of risk; and (4) an innovative concept of payment for services rendered out of future profits.

We must do due diligence on the entrepreneur not only to find projects that have the “DNA of an Elephant” (i.e. with potential to export or to support export projects) but also to ensure that the mind-set of the entrepreneur is well tuned and lubricated for the journey to business success

One of the first things on the entrepreneur’s mind is money and very often the entrepreneur is in search of other persons’ money rather than trying to build a savings account and invest his or her own money. This approach will result in very slow growth since the lack of access to money is frustrated by the perception of high risk and inhibits the development process.

We therefore have to be innovative and move away from the traditional loan concept which is not suitable for start-ups. We must introduce a quick response seed (a revolving and growth fund which can be innovatively rolled into equity) and a quick response equity model (with a strong working capital component that is consistent with the cash flow uncertainty which is endemic to start-up enterprises). A design has been developed for the Barbados Entrepreneurs’ seed/equity fund.

Shepherding using the ManOBiz™ Matrix as a shepherding tool is designed to reduce risk and hence provides protection to the investor. The value of shepherding has been discussed ad nauseam in this column but is really the key to success.

Finally, but quite innovatively, the concept of payment out of future profits may seem crazy given the traditional mind-set but in an innovative context it is doable and makes a lot of sense.

Start-up businesses have weak cash flows at the outset but if given the opportunity can grow quite quickly with the help of the entrepreneur, investor, marketer and the shepherd. Here, we encourage the entrepreneur to build a team where the funds taken out of the business for services rendered by the entrepreneur, investor, marketer and shepherd are commensurate with the cash flow growth of the business.

Let us engage the talent of the young leaders as it emerges, let us garner the experience of our elders before it fades into the sunset, and let us capture the energy of the youth as we innovate, remembering always that God is our refuge and strength, a very present help when in trouble.